I have been writing about how companies must embrace this new Answer and Recommendation environment, including the need for a senior role to manage the answers. I am again advocating for companies to spend time mining their on-site search query database. On-site search has always been under-respected in the world of search, despite it being a gold mine of information and a simple way to improve customer satisfaction on the website, identify product bugs and defects, and understand what information customers are interested in that they are not quickly locating.

In the “old days of SEO,” most keyword research best practice guides suggested that you look at them, but I have found very few companies that do it. A few years ago, at PubCon search conference, I asked a room of 250 SEO professionals how many had even looked at their site search queries, let alone mined them, and only four people raised their hands. My follow-up question is to understand why it proved fascinating. The majority admitted that they did not have time or did not think of it. A few replied that it would not yield any value and others admitted they did not know where to get the data. Interestingly, one of the four that were doing it revealed to me that they have identified tens of millions of dollars of opportunity mining theirs, which is why they have an analyst dedicated to the process.

Why are site search queries important?

I believe there are two key elements of value to site search queries and are a critical reason why companies need to give their system more attention to ensure they are optimized:

- Your Information – These searchers assume you have the information as they are doing it on your website. This is why I recommend brands review two critical site search reports. The first shows queries no results were returned, and the second shows queries for which no results were clicked. Both of these indicate potential problems with your data set.

- Insights into Needs/Wants/Assumptions—These queries can tell you what visitors are interested in, what problems they have, unanswered questions, and whether they cannot find something they expect to see.

To reiterate, these are questions being asked on your site about your products or services, giving you valuable insight into your customers and prospects. Unfortunately, too many companies fail to mine this significant database of consumer interests. I have noted multiple other benefits later in this post.

Understand what they are asking?

A few years ago, we mined a year’s worth of on-site search queries and questions from social media for a prominent tourist destination. More than a typical keyword research exercise, we were engaged in developing insights into those needs and wants of searchers, with specific emphasis on what questions were they asking related to the destination. Our first step was to segment them to identify and categorize the questions they were asking.

- 25 million unique queries

- 2,023 “asks” on social media

- 600,000 questions

- 27,211 unique questions

- 10,240 asking “how”

- 6,333 asking “what”

- 6,116 asking “can I/we”

- 2,116 asking where

- 1,505 asking “when”

Monetizable Queries

Another key activity was identifying monetizable queries or those with the potential for a transaction. For example, questions about upgrades, multi-day passes, and parking. Some of the more popular revenue potential questions were the following:

- Where can I purchase family pass tickets online?

- Can I upgrade my day ticket to an annual pass?

- Can I upgrade my single park pass to full access?

- Can I upgrade from a single day to a multi-day pass?

- Can we prepay for parking?

- Where can I purchase “front of the line” access?

The Monetization Opportunity

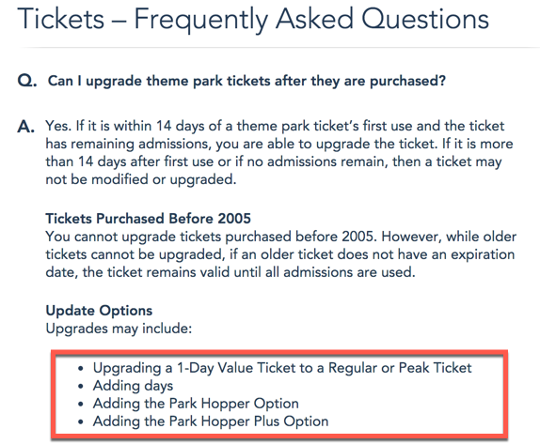

The monetization opportunity theory was fairly simple: if the searcher’s question was about upgrading from a day pass to an annual pass or from a single park to a multi-park, they should be able to click a link and upgrade online or at least be given instructions on where to go at the park or who to call online.

After applying the monetization filters, we found 225,000 monthly searches, 15% of the total searches, were potentially monetizable. The Marketing Director aggregated and averaged the initial rough model’s product conversion rates and conversion value. Using an average conversion value of $200 and an average conversion rate of 10%, effectively monetizing these 225,000 monthly queries could generate $4.5 million in incremental revenue or $54 million annually. Even if we did not hit that revenue level, the insight into the level of interest in the various upgrades and paid amenities was a goldmine to the customer insights team.

60% Lacked Answers

This virtual goldmine of incremental revenue and insights was the opportunity and the challenge. Taking the next step, we used onsite search insights and ran traditional organic search ranking reports for the queries. We found that 60% of the monetizable questions had neither an answer nor a partial answer, and none had links to a conversion method. For a number of the questions, the website FAQ would be like this example: “Yes, you can convert or upgrade a day pass to an annual pass,” with no indication of where or how to do it. While true, the question was correctly answered, and there was no active step to convert them.

Resistance to Opportunity Capture

You might assume that with the potential to capture $4.5 million in incremental revenue each month, the team would jump at this opportunity. That was not the case, and there were some interesting barriers from a variety of stakeholders that we needed to overcome. In cross-unite KPIs fighting for the same revenue pool, changes in any process can be challenging. While the money ends up in the same pot at the end of the day, most organizations are not set up to reallocate cannibalized revenue.

Management & Revenue Opportunity

Management jumped on the chance to capture this revenue and how quickly it could be captured. By sorting the questions by opportunity, revenue potential, and available content, we started to develop a content requirements plan. They also questioned why no one internally had identified this opportunity.

Content Creation Dilemma

The content team did the mental math that 60% of the queries did not have content and/or that almost every FAQ would need to be edited at least to add links to a method of converting customers. Given their already full load, resisted the idea of working on mind-numbing FAQ content at this scale. Multiple teams jumped into the project to aggregate existing content and collaborate with the various stakeholders of these products to identify what should be written that would be informative, legal, and can convert.

Call Center Team

The call center team was another team that pointed out the myriad of challenges and complexities this may create, from managing the information to the need for additional toll-free numbers to how to align these answers with the current customer service operators. Ironically, it was with its group that we got the answers to many of these questions. The current call center agent database had about 25% of these questions in their system, with the approved answer, the different up/cross sell suggestions, and recommendations on how to get callers to convert.

Revenue Cannobalization

The most interesting barrier came from those who might lose revenue in this new quest for gold, and the impact on their respective KPIs, that is always a problem when you have multiple departments fishing in the same revenue pool, changes in any process can be challenging. While the money ends up in the same pot at the end of the day, most organizations are not set up to reallocate cannibalized revenue. For example, the aforementioned call center anticipated fewer people because they already knew the site did not have the answers as many callers told them. This allowed them to cross-sell via the phone. The affiliate program manager, who also knew that partners were answering these questions and using their lack of bureaucracy made it easier fo them to create content to upsell customers. By the brand offering this information, it would cause friction for her, especially with more significant partners. The manager of the on-location customer service teams also voiced concern with the revenue impact of pre-booking.

Ultimate Performance

In the end, senior management felt that the investments in content were worth the changes, and getting the money before they arrived at the park, often many months in advance, was well worth the changes. They ultimately adjusted the various revenue source goals of the different teams. After my scope of work, and when I stopped working with them, the content team ultimately edited and created nearly 1,000 questions. Over time, the questions were put into more than a dozen buckets with their conversion and average sales. The more monetizable questions, the immediate conversion rate was 22% and the average monthly review of $6.8 million. A frustrating sad note: It looks like a recent redesign of the website eliminated many of the highly effective FAQs and replaced those content modules with a less than adequate chatbot engine.

Additional Benefits

Identify Content and Navigation Gaps

A few years ago, a prominent B2B site refreshed its international home pages, removing many product links and replacing them with interactive links based on where the visitor moused over. We found that nearly 85% of the non-US users who came directly to the home page immediately went into site search. After researching the phenomenon, the UX team determined that the users were not recognizing or did not want to deal with the mouse-over functions and were going into site search to find what they wanted. They reverted to the original version and made other adjustments for mobile devices. Immediately, the home page site search rate dropped to less than 10% of the level it was before the significant refresh. Little by little they adjusted the home page to include visual clues to the most common areas of the site, which struck the balance of creativity and function.

Identifying Non-Relevant Paid Search Queries

When I see an increase in site search, especially for a specific topic, I look for paid search ads driving visitors to a non-relevant page. In one example, a B2B company was gating paid search visitors only to allow them to download a whitepaper for a broader topic. The searchers wanted something other than the whitepaper, as nearly 65% used site search to find what they wanted. The PPC vendor wanted to remove site search from the navigation to stop this, but it would only lead to increased use of the back button.

Reviewing the keywords and searcher intent demonstrated that the campaign was particular in its goal, but the agency was using too broad words. They adjusted the words and ad copy to make it more focused on the whitepaper’s contents. While this did decrease ad clicks, there was a significant increase in engagement with only the occasional site search query. Secondarily, we increased performance in organic results by removing those broad paid ads for those other words that triggered site search. We also revised the ad targeting rules and the agency secured incremental budget for awareness campaigns to better interact with the searchers who wanted more specific information than getting the whitepaper.

Identify Bugs, Parts Obsolescence and Customer Challenges

Over the years, we worked with software and enterprise computer hardware companies to implement rules and triggers related to error codes, bug variables, and other signals to indicate a problem with their products. For example, any error code that was searched for than 5 times in a week or any “never searched” error code, it would flag the support team to see if there was a release that would have impacted the system to cause an increase in those errors.

Working with companies that have large databases of repair parts, we created similar flags to identify an increase in searches for replacement parts. This may indicate defects or other problems that the organization can review to preempt large-scale recalls or injuries.

This required a process to ensure that error and system codes, part numbers, and other information were frequently added to the site search database. However, this will not happen unless you make it part of the workflow to submit it or dynamically feed it from internal repositories.

Finding Product-Market Fit

Over the years, I have had numerous companies leverage keyword research, specifically their site search data, to help identify new products with demand. Using query data to determine the right product-market fit in advance can save you significant time in R&D and market discovery. I first discovered this angle of site search gold more than twenty years ago working with National Instruments, now NI.

When mining site search queries, we identified several trends and interests, especially around variations of the phrase USB and other emerging technologies. This was brought to the attention of the R&D, technology, and marketing committees, who realized they already had technology that was not commercialized or identified as not commercially viable and prioritized for further review and development. This application of query data was referenced by the Wall Street Journal article “The New Benefits of Web-Search Queries,” which explained how NI and a few other companies used keyword research to either develop products or validate market interest.